- For the Curious Investor

- Posts

- Demand is Back: Why Multifamily Absorption Signals a Turning Point

Demand is Back: Why Multifamily Absorption Signals a Turning Point

Thin yield spreads and oversupply are cooling once-hot Sunbelt metros, while affordable housing and Midwest balance are keeping investors in the game.

In this Issue

Macro Pulse — Why the national market just had its strongest quarter in years.

Feature Story

Macro Pulse

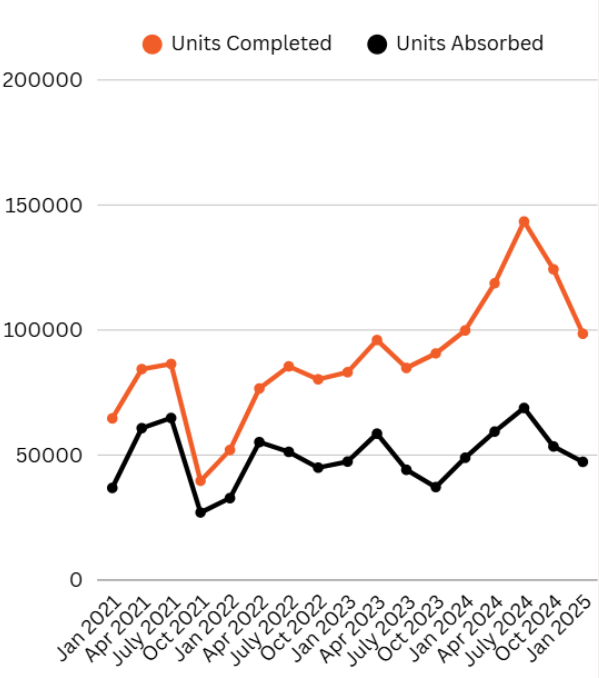

Every market has a rhythm. For the past two years, supply had the upper hand — thousands of new apartments delivered while renters couldn’t quite keep up.

But in Q2 2025, the music changed. The U.S. absorbed a record 188,200 apartments — more than two leased for every one completed. Vacancy fell to 4.1%, one of the sharpest quarterly drops on record. In other words, the renters came back in force.

At the same time, the flood of new construction is receding. Developers have cut back hard; new starts are down 74% from their 2021 peak. This means that by 2026, even oversupplied metros like Austin and Phoenix may find balance again as the pipeline thins out.

But here’s the catch: not all markets are sharing in the good news. The Midwest is leading rent growth (+3.7% YoY) because it never overbuilt, while Sunbelt and Mountain markets — Austin, Phoenix, Denver — are still digesting a backlog of new supply.

And investors must measure everything against today’s capital backdrop: Treasuries are paying 4–4.5%. Multifamily cap rates average around 5.7%. That leaves a thin margin. Which means if you’re going to take on the risks of real estate — illiquidity, operating costs, and vacancies — you want to be in markets where the fundamentals truly tip in your favor.

For the first time since 2022, demand is decisively outpacing supply — two units leased for every one delivered. With construction starts down ~74% from peak, the gap could widen further in 2026, setting the stage for tighter markets ahead.

Market Spotlights

Austin, TX – Oversupply Burnout with Submarket Splits

Austin tells the classic boom-and-bust tale. In 2024 alone, it delivered 31,000 new apartments — more than double what renters could absorb. As a result, rents are down 4% YoY, and Class A landlords are offering concessions to lure tenants.

But zoom in, and the story gets more nuanced. East Austin and Riverside rents are up +3% since 2022, while the West Side stagnates. Austin’s office market remains bruised with ~25% vacancy, though industrial is thriving thanks to new manufacturing growth.

Affordable housing is the steady drumbeat underneath all this noise. With median rents above $1,700, many renters simply can’t afford new Class A towers. Subsidy-backed affordable projects fill instantly and are far less exposed to oversupply.

Investor Insight: Austin’s oversupply makes luxury risky today. Industrial is the safe bet, and affordable housing is the only residential play insulated from the storm.

Austin delivered over 31,000 new units in 2024, more than double what renters could absorb. Oversupply is pushing vacancies up and rents down, though submarkets like East Austin remain resilient.

Atlanta, GA – Demand Surging, Supply Cooling

Atlanta is quietly staging a comeback. In Q2 2025, it absorbed 6,600 units versus 3,200 delivered — a 2:1 demand-to-supply ratio. That was the metro’s 11th straight quarter of positive absorption. Vacancy nudged down to 90.6% occupancy, and while rents are still -2.6% YoY, momentum is finally turning.

The pipeline is shrinking too — just 14,400 units underway, the lowest in years. Office remains a weak link with 24.8% vacancy, and industrial is healthy but softening. Yet investors are circling. Groups like Penler, backed by Carlyle, are buying discounted assets, betting that supply pressure is easing and the rebound is underway.

Affordable housing is Atlanta’s hidden story. The metro lost 230,000 affordable units between 2018 and 2023, and subsidies can’t keep up. That gap means affordable deals not only pencil but thrive even while Class A stumbles.

Investor Insight: Atlanta’s absorption strength signals a recovery ahead. Affordable and family-focused units stand to outperform as the city’s fundamentals realign.

Atlanta absorbed more than 6,600 units in Q2 2025, nearly double completions that quarter. The pipeline has dropped to its lowest in years, signaling that strong demand is finally catching up as new supply eases.

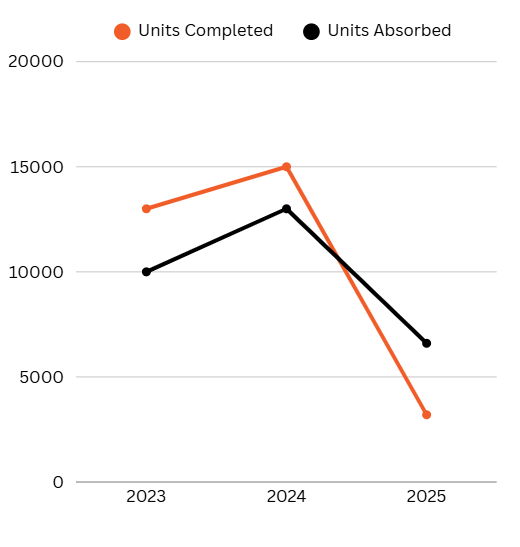

Charlotte, NC – Luxury Weighs, Affordable Steadies

Charlotte has been busy. In the past 12 months, it delivered 15,500+ units, pushing vacancy up to ~7%.

But like Austin and Atlanta, submarkets tell different stories. Uptown and South End, where luxury rents hover around $2,000, are saturated. Outer suburbs like Gaston and Concord, with lower rents and 94%+ occupancy, remain healthier.

Affordable housing is a clear outperformer. State bond and tax credit allocations are expanding, making subsidized deals more financeable than conventional luxury projects that now require optimistic rent growth assumptions.

Investor Insight: Charlotte is a steady ship. Class A is wobbling downtown, but affordable projects are benefitting from both financing tailwinds and stronger demand in the suburbs.

Charlotte delivered more than 15,500 units over the past year, while absorption trailed closer to 13,000. Uptown and South End face oversupply pressure, but suburban submarkets remain healthier with tighter occupancy.

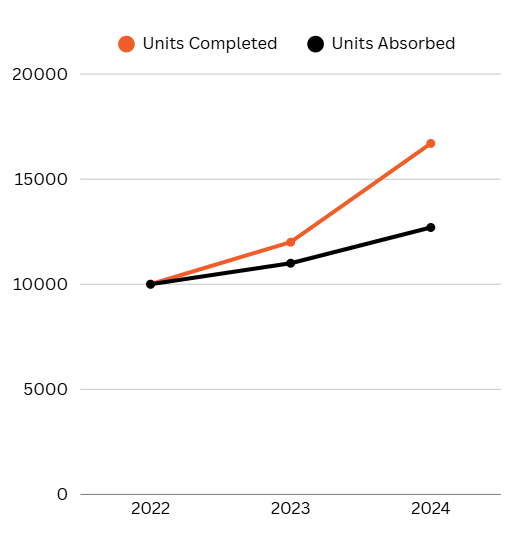

Kansas City, MO/KS – Quiet Outperformer

Kansas City doesn’t get flashy headlines, but it doesn’t need them. Vacancy is just 3.6%, well below the national average. Rents are up +4.9% YoY, among the highest in the U.S.

Through mid-2025, KC absorbed 3,700 units versus 2,200 delivered, proving its pipeline is perfectly balanced with demand. Rents remain affordable (~$1,200–1,300), keeping demand sticky.

Affordable housing is the strongest angle here. Long waitlists, little new supply, and growing subsidy support are drawing investors who prefer steady growth over volatility.

Investor Insight: Kansas City is the contrarian winner — balanced supply, sticky renter demand, and strong affordable fundamentals make it one of the safest multifamily bets today.

Kansas City’s fundamentals remain steady. In 2024, the metro absorbed about 6,500 units against ~7,300 completions, keeping vacancy at just 3.6%. Affordable rents and manageable pipelines make it one of the nation’s most balanced markets.

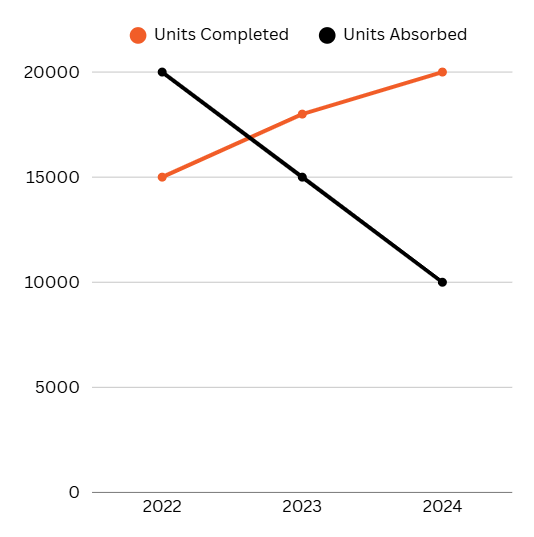

Phoenix, AZ – From Boom to Balance

Phoenix was the poster child of the pandemic boom, adding nearly 90,000 new residents in 2021. But it also overbuilt. Today, rents sit around $1,500, and YoY growth is still negative.

The tide is shifting. Roughly 10,000 units have been canceled or delayed, giving absorption a chance to catch up. Vacancy is easing as demand steadies, while industrial remains a bright spot.

But cap rates are tight here: deals trade around 4.9%, barely above Treasuries. That razor-thin spread makes conventional Class A risky. Affordable housing, by contrast, has overwhelming demand and far less competition.

Investor Insight: Phoenix is recalibrating. Class A still struggles with thin yields, but affordable housing has space to run as supply retreats.

Phoenix has swung from pandemic boom to oversupply. By 2024, completions hit ~20,000 while absorption dropped to ~10,000. With ~10,000 units canceled or delayed, the pipeline is thinning, but the metro is still digesting excess supply.

Investor Takeaway

Multifamily is at a turning point. Demand is back — national absorption just hit a record — and the supply wave is finally breaking. But not all markets are equal.

Austin and Phoenix remain oversupplied but will likely balance by 2026. Affordable housing is the safer path in both.

Atlanta is showing powerful absorption momentum, with affordable projects best positioned for upside.

Charlotte is steady but uneven: luxury wobbles, affordable stays firm.

Kansas City proves boring pays — balanced, affordable, and outperforming.

Against alternatives, the story is clear: office is still impaired, industrial is strong but priced tight, and Treasuries at 4%+ are a low-risk competitor. That means multifamily must deliver durable, risk-adjusted returns. And across every metro, affordable housing is the one strategy consistently clearing that bar.

📬 We’re actively acquiring properties. If you're exploring a sale, off-market or on-market, we’re interested.

Reply to start the conversation.